Grayson County Real Estate Taxes . our grayson county property tax calculator can estimate your property taxes based on similar properties, and show you how your. This property tax estimator is provided as a convenience to taxpayers. If you are a homeowner who has attained age 65 or older, you may also defer or postpone paying. Every effort has been made to offer the most current and correct information. the median property tax in grayson county, texas is $1,519 per year for a home worth the median value of $99,600. grayson central appraisal district is responsible for appraising all real and business personal property within grayson county. 2024 values are preliminary and subject to change:

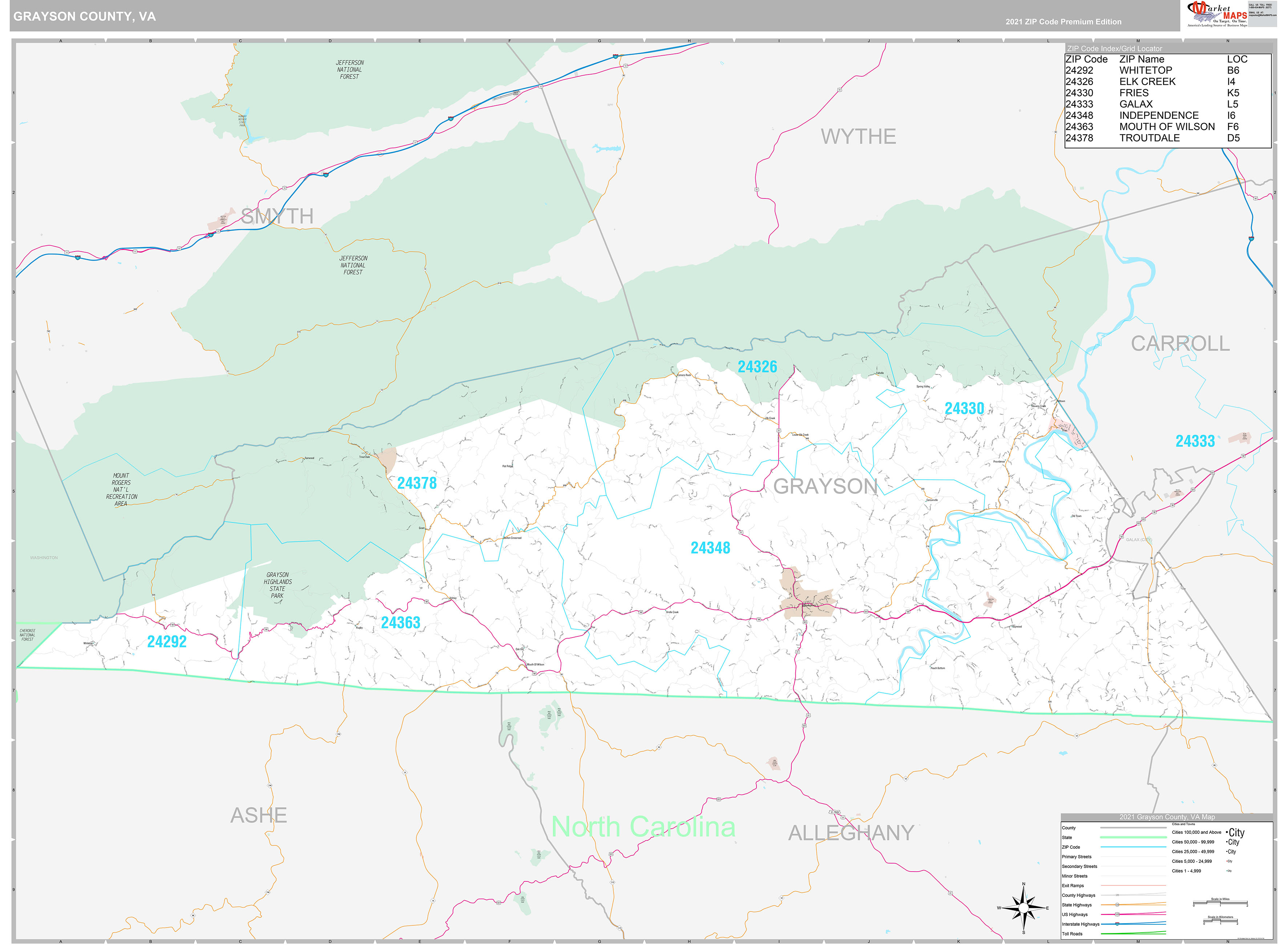

from www.mapsales.com

grayson central appraisal district is responsible for appraising all real and business personal property within grayson county. our grayson county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Every effort has been made to offer the most current and correct information. 2024 values are preliminary and subject to change: the median property tax in grayson county, texas is $1,519 per year for a home worth the median value of $99,600. If you are a homeowner who has attained age 65 or older, you may also defer or postpone paying. This property tax estimator is provided as a convenience to taxpayers.

Grayson County, VA Wall Map Premium Style by MarketMAPS

Grayson County Real Estate Taxes our grayson county property tax calculator can estimate your property taxes based on similar properties, and show you how your. This property tax estimator is provided as a convenience to taxpayers. 2024 values are preliminary and subject to change: Every effort has been made to offer the most current and correct information. our grayson county property tax calculator can estimate your property taxes based on similar properties, and show you how your. grayson central appraisal district is responsible for appraising all real and business personal property within grayson county. If you are a homeowner who has attained age 65 or older, you may also defer or postpone paying. the median property tax in grayson county, texas is $1,519 per year for a home worth the median value of $99,600.

From www.land.com

27.74 acres in Grayson County, Texas Grayson County Real Estate Taxes our grayson county property tax calculator can estimate your property taxes based on similar properties, and show you how your. If you are a homeowner who has attained age 65 or older, you may also defer or postpone paying. This property tax estimator is provided as a convenience to taxpayers. the median property tax in grayson county, texas. Grayson County Real Estate Taxes.

From summitmoving.com

Cuyahoga County Property Taxes 🎯 2024 Ultimate Guide to Cuyahoga Grayson County Real Estate Taxes the median property tax in grayson county, texas is $1,519 per year for a home worth the median value of $99,600. grayson central appraisal district is responsible for appraising all real and business personal property within grayson county. Every effort has been made to offer the most current and correct information. our grayson county property tax calculator. Grayson County Real Estate Taxes.

From www.forsaleatauction.biz

Grayson County, VA Sale of Tax Delinquent Real Estate Grayson County Real Estate Taxes Every effort has been made to offer the most current and correct information. grayson central appraisal district is responsible for appraising all real and business personal property within grayson county. This property tax estimator is provided as a convenience to taxpayers. If you are a homeowner who has attained age 65 or older, you may also defer or postpone. Grayson County Real Estate Taxes.

From www.land.com

2.9 acres in Grayson County, Texas Grayson County Real Estate Taxes 2024 values are preliminary and subject to change: our grayson county property tax calculator can estimate your property taxes based on similar properties, and show you how your. This property tax estimator is provided as a convenience to taxpayers. the median property tax in grayson county, texas is $1,519 per year for a home worth the median. Grayson County Real Estate Taxes.

From www.landsoftexas.com

3.23 acres in Grayson County, Texas Grayson County Real Estate Taxes our grayson county property tax calculator can estimate your property taxes based on similar properties, and show you how your. This property tax estimator is provided as a convenience to taxpayers. If you are a homeowner who has attained age 65 or older, you may also defer or postpone paying. 2024 values are preliminary and subject to change:. Grayson County Real Estate Taxes.

From hxeyyqvrq.blob.core.windows.net

Grayson County Ky Zoning at Edgar Stone blog Grayson County Real Estate Taxes the median property tax in grayson county, texas is $1,519 per year for a home worth the median value of $99,600. Every effort has been made to offer the most current and correct information. grayson central appraisal district is responsible for appraising all real and business personal property within grayson county. If you are a homeowner who has. Grayson County Real Estate Taxes.

From dxouazrnh.blob.core.windows.net

Clinton County Real Estate Tax Lookup at Eleanore Davis blog Grayson County Real Estate Taxes grayson central appraisal district is responsible for appraising all real and business personal property within grayson county. Every effort has been made to offer the most current and correct information. the median property tax in grayson county, texas is $1,519 per year for a home worth the median value of $99,600. our grayson county property tax calculator. Grayson County Real Estate Taxes.

From hxeatxsir.blob.core.windows.net

Grayson County Ky Property Tax Rate at Malcolm Lomax blog Grayson County Real Estate Taxes 2024 values are preliminary and subject to change: Every effort has been made to offer the most current and correct information. our grayson county property tax calculator can estimate your property taxes based on similar properties, and show you how your. This property tax estimator is provided as a convenience to taxpayers. grayson central appraisal district is. Grayson County Real Estate Taxes.

From www.paramountpropertytaxappeal.com

Harris County Property Tax site Grayson County Real Estate Taxes This property tax estimator is provided as a convenience to taxpayers. If you are a homeowner who has attained age 65 or older, you may also defer or postpone paying. the median property tax in grayson county, texas is $1,519 per year for a home worth the median value of $99,600. our grayson county property tax calculator can. Grayson County Real Estate Taxes.

From www.forsaleatauction.biz

Grayson County, VA Sale of Tax Delinquent Real Estate Grayson County Real Estate Taxes the median property tax in grayson county, texas is $1,519 per year for a home worth the median value of $99,600. If you are a homeowner who has attained age 65 or older, you may also defer or postpone paying. 2024 values are preliminary and subject to change: This property tax estimator is provided as a convenience to. Grayson County Real Estate Taxes.

From hxeatxsir.blob.core.windows.net

Grayson County Ky Property Tax Rate at Malcolm Lomax blog Grayson County Real Estate Taxes Every effort has been made to offer the most current and correct information. the median property tax in grayson county, texas is $1,519 per year for a home worth the median value of $99,600. This property tax estimator is provided as a convenience to taxpayers. our grayson county property tax calculator can estimate your property taxes based on. Grayson County Real Estate Taxes.

From www.landsoftexas.com

31.4 acres in Grayson County, Texas Grayson County Real Estate Taxes 2024 values are preliminary and subject to change: This property tax estimator is provided as a convenience to taxpayers. Every effort has been made to offer the most current and correct information. If you are a homeowner who has attained age 65 or older, you may also defer or postpone paying. the median property tax in grayson county,. Grayson County Real Estate Taxes.

From propertytaxloan.com

Property Tax Loan in Grayson County Ovation Lending Grayson County Real Estate Taxes the median property tax in grayson county, texas is $1,519 per year for a home worth the median value of $99,600. Every effort has been made to offer the most current and correct information. our grayson county property tax calculator can estimate your property taxes based on similar properties, and show you how your. This property tax estimator. Grayson County Real Estate Taxes.

From materialfulldioptric.z13.web.core.windows.net

Information On Property Taxes Grayson County Real Estate Taxes If you are a homeowner who has attained age 65 or older, you may also defer or postpone paying. Every effort has been made to offer the most current and correct information. This property tax estimator is provided as a convenience to taxpayers. 2024 values are preliminary and subject to change: the median property tax in grayson county,. Grayson County Real Estate Taxes.

From www.realtor.com

Grayson County, KY Real Estate & Homes for Sale Grayson County Real Estate Taxes This property tax estimator is provided as a convenience to taxpayers. our grayson county property tax calculator can estimate your property taxes based on similar properties, and show you how your. grayson central appraisal district is responsible for appraising all real and business personal property within grayson county. Every effort has been made to offer the most current. Grayson County Real Estate Taxes.

From dxotrilsj.blob.core.windows.net

Caroline County Real Estate Tax Bill at Brad Medina blog Grayson County Real Estate Taxes 2024 values are preliminary and subject to change: grayson central appraisal district is responsible for appraising all real and business personal property within grayson county. the median property tax in grayson county, texas is $1,519 per year for a home worth the median value of $99,600. If you are a homeowner who has attained age 65 or. Grayson County Real Estate Taxes.

From graysoncounty.texas.recordspage.org

Free Grayson County Public Records Search (Marital, Warrants, Arrests Grayson County Real Estate Taxes This property tax estimator is provided as a convenience to taxpayers. grayson central appraisal district is responsible for appraising all real and business personal property within grayson county. our grayson county property tax calculator can estimate your property taxes based on similar properties, and show you how your. the median property tax in grayson county, texas is. Grayson County Real Estate Taxes.

From www.forsaleatauction.biz

Grayson County, VA Sale of Tax Delinquent Real Estate Grayson County Real Estate Taxes Every effort has been made to offer the most current and correct information. grayson central appraisal district is responsible for appraising all real and business personal property within grayson county. If you are a homeowner who has attained age 65 or older, you may also defer or postpone paying. This property tax estimator is provided as a convenience to. Grayson County Real Estate Taxes.